Discover More Card

If you’re worried about your credit card history, and have a few bad debts (and yes; there is a such thing as ‘good’ debt), there are only a handful of credit cards that aren’t trying to charge you an annual fee that you can get.

If you’re worried about your credit card history, and have a few bad debts (and yes; there is a such thing as ‘good’ debt), there are only a handful of credit cards that aren’t trying to charge you an annual fee that you can get.

I’m not saying it doesn’t make sense to pay for a credit card, since the right one can get your credit history and credit score back out of the red – but let’s face it; no one really wants to pay for one unless they’re rich and it’s the AMEX Centurion.

Back before I had the finances for a Visa Black Card, I applied for the Discover Card despite several thousand-dollars’ worth of college debt, even though I was pretty sure it was a shot in the dark (I’d been rejected for maybe 6 credit cards up to that one).

I only signed up for this final credit card because I’d finally resolved to settle all my debts; I intended to use this most recent rejection (presumed, as it turned out) to obtain a free copy of my credit report and start tracking down my responsibilities.

Imagine my shock when the Discover More Card came in a packet too big to be merely a “We’re sorry, but at this time we cannot offer…”.

Imagine my shock when the Discover More Card came in a packet too big to be merely a “We’re sorry, but at this time we cannot offer…”.

I opened it up and the first thing I saw was a credit limit of $2000 and a cash advance credit line of $800.

Gee Willickers (I can’t believe I just said that). This absolutely strengthened my resolve not to let anything having to do with credit ever get out of hand again – I’m no longer 17-18 years old, after all.

In short, the Discover More is a card you might consider – so I’ll provide the details below:

- An Introductory APR of 3.99% for the first 6 months. After half-a-year, the APR will jump to 22.99% and will then vary with the market as determined by the Prime Rate. Of course, if you pay off your balance by the end of each billing period (25 days or so – be sure to check your account) you get charged nada interest.

As an example, I borrowed $500 at the 3.99% APR (eager to test out the card, as you can see!) and paid it back at $200 each month.

The total amount of interest I paid on the principal was a cup of Starbucks coffee – $3.01. Check out the interest rate calculator below to try some figures of your own with different Annual Percentage Rates:

- The cash advance APR is 24.99% right from the get-go – I never do cash advances anyway, since I’m trying to build my credit score up and won’t risk it.

- You’ve got 25 days after the close of the last billing period to get all your payments squared away before you get hit with either an interest charge, a late fee of up to $35, or both. Don’t let neglect come back to bite you; set your phone to remind you 3 days beforehand, and then again the day before – keep in mind up to 3 hours’ difference between US coasts. I always give myself a strict deadline of exactly 3 weeks – 21 days.

- The minimum payment each month is at least $20; unless of course your entire balance is lower than that (3% of your balance, if I understand it correctly).

- Balance transfers at the introductory APR of 3.99% and then 22.99% after the 6 month honeymoon period is over.

A word of caution on the interest charge: if you use your Discover More card to buy dinner or have some other relatively inexpensive endeavor, and have a balance of $40, try to pay it all off – the minimum interest charge won’t be less than $2 no matter how little you have on there. No sense in getting charged interest as if you had several hundred dollars on there when you’ve only got $20 – unless it really can’t b avoided, of course.

A word of caution on the interest charge: if you use your Discover More card to buy dinner or have some other relatively inexpensive endeavor, and have a balance of $40, try to pay it all off – the minimum interest charge won’t be less than $2 no matter how little you have on there. No sense in getting charged interest as if you had several hundred dollars on there when you’ve only got $20 – unless it really can’t b avoided, of course.

- NO ANNUAL FEE!!!!!!!! Hooray.

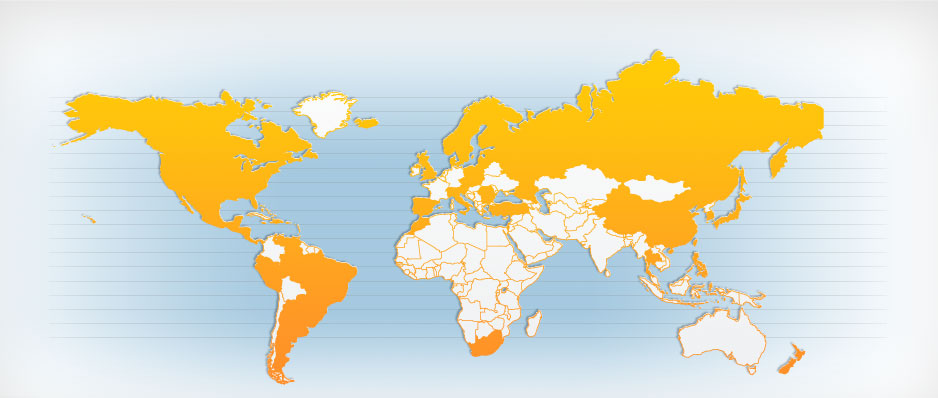

Discover Card Worldwide Coverage

That’s about it for now; I’ll be back shortly with another post about the Discover More card’s cash-back program details – it’s a good one. Feel free to comment below – just don’t leave any links in the body; put them in the provided box that says “website”. Thanks for reading!