Bitcoin News – The Cryptocurrency Investment Vehicle

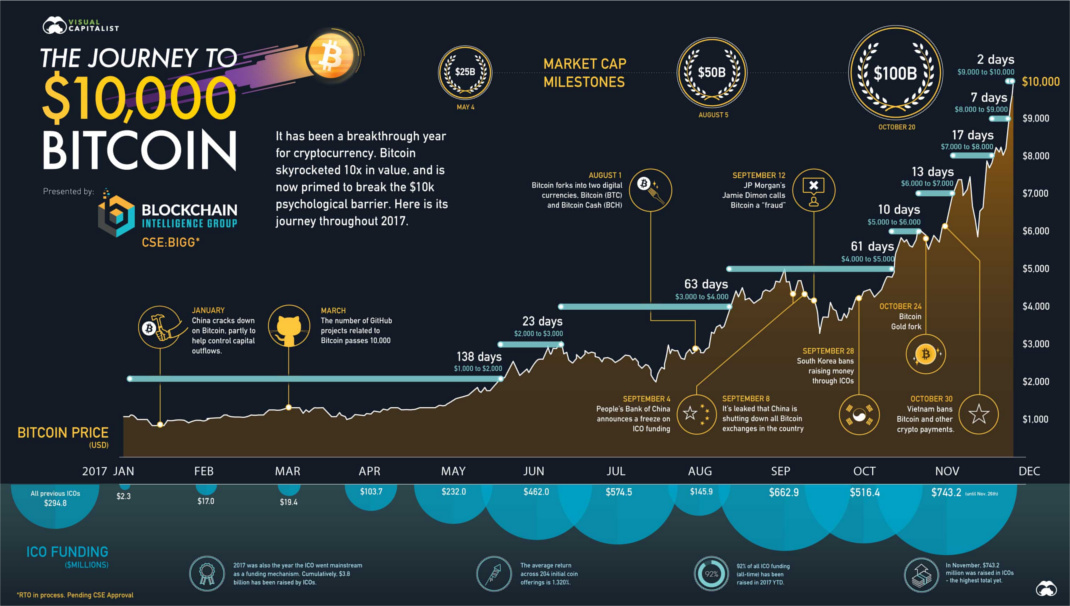

Navigating the world of cryptocurrencies and Bitcoin news can be a daunting task for the beginner. After all, with tens of thousands of them in existence – and literally thousands listed on the common exchanges – how do you know which ones to invest in? After all, given the explosion of Bitcoin in mid-2017 to nearly $20,000 per, wouldn’t it be potentially life-changing if you could win an amount in the vicinity of this?

Of course, even the experts cannot fully predict when one of the numerous coins will explode in value – or even IF it will, ever. So what can the common man do to wade into these waters? Well, let us see if the following Bitcoin investment method speaks to you. More broadly, it is a cryptocurrency method that can be used for any number of the available digital coin…

The Digital Currency Investment Method

It’s really quite simple, and is how the beginner should approach just about ANY speculative endeavor. First, set aside as much money as you can afford to lose (possibly an oxymoron in these trying economic times; but we have to start somewhere). For us, we looked at our finances and decided that we had $800 to spare. You can obviously use a lot less – perhaps even $50 will do. After all, the amount of money you may gain should ALWAYS be commensurate with the amount of risk that you’re willing to take.

We recommend (strongly) that you do not take a big risk with this method, as our rationale is, “how often do you realize that, after several months have passed, that you spent several hundred dollars on things you didn’t even use, or could totally have done without? Would it not be better to have a similar amount of money invested, and possibly accruing interest during that same amount of time? This, at its heart, the essence behind the motivation of conservative investing.

Choosing the Right Cryptocurrency

First, you need to find a handful of digital currency – Bitcoin should be one of them, of course – in which to invest. It is doubtful that the others will explode in value and leave Bitcoin behind; more likely, the fates of the others are inextricably intertwined with Bitcoin, such that if Bitcoin rises, there will be residual benefits that unlock the potential of the others. At the very least, this is a working theory that saw some validation last year when Bitcoin skyrocketed to the $20,000 realm – Litecoin, Ethereum, Bitcoin Cash and others rose right along with it.

When you choose, you want to scoop up digital coin that has a robust trading volume, as well as a small trading value per “share”. The rationale for the former is obvious – after all, you want something that is being traded by many players, which increases the chances that it gets picked up by major merchants in the future as a payment option. This will then cause a bit of a runaway reaction by encouraging even more people to trade it.

As for the latter (small trading value), the lower the trading value the more of them you can get and the more room it has to move up in value. Imagine, for example, buying a digital coin that is currently trading at under $1 – say, at 4 cents or something. If you spend $50 and buy 1,250 of this one, and the value somehow climbs to something like $23, then you’ve turned you $50 investment into $28,750!

It is with this in mind that we pick the following 8 cryptocurrencies in which to invest our modest sum of disposable cash. Additionally, you want a robust enough market cap and trading volume that it would take the full economic might of even an institutional investor to significantly alter the trading landscape with a single action.

Bitcoin and the Rest

As of early November 2018:

- Bitcoin $6,408 Mkt Cap: $111 billion Trad Vol: $4 billion

- Ethereum $211 Mkt Cap: $22 billion Trad Vol: $2 billion

- XRP $0.50 Mkt Cap: $20 billion Trad Vol: $511 million

- BCH $543.3 Mkt Cap: $9 billion Trad Vol: $850 million

- EOS $5.41 Mkt Cap: $5 billion Trad Vol: $717 million

At this point, we now choose several more without worrying too much about the trading volume, For these, we are excited about the tiny current values of the coin, which leaves a lot of leeway for growth; in fact, they are more sensitive precisely the kinds of changes that can inspire tremendous growth. As such, consider XLM(Stellar) = $0.2151, ADA Cardano = $0.0727, TRX(TRON) = $0.0237, XEM(NEM) = $0.0935, DOGECOIN = $0.0051585. (BCN)Bytecoin = $0.0013589, Siacoin = $0.0063137. There are hundreds more – and growing – but we think this is good enough. The others mostly seem to have sprung up during the surge of the first few (as expected) and we cannot vouch for them without first researching them.

- XLM $0.2563 Mkt Cap: $5 billion Trad Vol: $5 billion

- ADA Cardano $0.0744 Mkt Cap: $2 billion Trad Vol: $24 million

- TRX $0.0231 Mkt Cap: $2 billion Trad Vol: $52 million

- XEM $0.0923 Mkt Cap: $831 million Trad Vol: $5 million

- DOGE $0.0030995 Mkt Cap: $362 million Trad Vol: $18 million

- BCN $0.0012893 Mkt Cap: $237 million Trad Vol: $435 thousand

- ***MIOTA (IOTA) – invest in this one, myself. Research the team behind each crypto on the list

Calculating How Much to Allocate to Each

No matter what particular cryptocurrency investment vehicle you’re using, it is rarely an easy decision to know when to pull out and count your winnings. Obviously, if you’re a long-term investor in a dividend stock, this is a lot easier since you’re seeing some financial return every quarter. But how do you know when enough is enough with Bitcoin or other digital coin? It’s tempting to keep on riding a current wave – even though you know that all crests have a trough.

Here’s the investment method we use for speculative digital currency: pay off your credit card bills. Simple, isn’t it? Let’s say you’re carrying a balance on several different cards; would it not be a great idea to finally get rid of this money-siphoning interest payments and have more credit available for future business decisions (potentially)? Consider the following hypothetical breakdown:

Capital One Venture $1050

Capital One Platinum $890

Capital One Quicksilver $680

Capital One Spark Business $440

Discover More Card $2300

Let’s say you have $100 to spare for each of the lower market capitalization digital currency above – XLM, ADA Cardano, TRX (TRON), XEM Stellar, Dogecoin and Bytecoin. That’s $600 total that you would need in order to invest in them.Now, let’s take their highest current price spikes in the years of their existence, to see what your return would be if you had cashed out at each of their peaks.

XLM reached a high of $0.9158 on Jan 18, 2018. So a $100 investment at the current price, cashed out at that price, would give you $357. ADA Cardano reached a high of $1.15 on January 4, 2018. A $100 investment at the current price would give you $1,158. TRX Tron reached a high of $0.2548 on January 4, 2018. A $100 investment at the current price of $0.0230 would give you $1,108. XEM Stellar hit a high of $2.02 on January 2, 2018. Cashing out a current-price $100 investment at this value would yield a sum of $2,193. Dogecoin is next, and it is particularly attractive because of its very low value – which (at least numerically) allows a lot of room for growth. The highest price for Dogecoin to date has been $0.0174 and occurred on January 6, 2018. It’s current price in November of 2018 is $0.0031064. $100 of Dogecoin now, cashed out at the max price ever yields $560.

Thus, all told, your $600 investment in the above 6 digital coin would yield $5,376. The hypothetical credit card bill posed up above comes out to $5360 – which means you could be debt-free in such a scenario. Another addendum to this investment scenario is (just in case you feel tempted to keep money in and continue riding the wave) to add an extra $100 to the $600 you invested in the entire thing. This means you spread out that extra $100 over all 6 digital coin; so about $16 each (or you could just throw $20 towards each one for $120 total).

This is an amount that you are willing to risk fully, since there’s no telling how high any surge will truly go. This strategy helps psychologically, too – you make sure you hit the target you set of paying off some – or all, even – of your credit card debt; but you’re not totally out of the game, either. $20 worth of Ripple (XRP) would be worth, if it ever hit some of the rather more optimistic highs based on calculation of the rising transaction costs of $40, a cool $40,000. It could take half a decade to reach that, if it is at all even possible.

If each one of these could possibly reach above $1, probably riding on the strength of a surge in Bitcoin (which is the one you should watch because of its superior market capitalization and public interest), then it would become extremely tempting to cash out – which is why you need to set a standard to prepare for a continued rise in value.

Our Cryptocurrency Pet Project – Analyzing MIOTA (IOTA)

Although you won’t find this digital coin listed above, we chose it more as a pet project of sorts. The driving factor in this decision was its very low current cost – which makes it attractive even though we haven’t done the research on it yet. Here’s the breakdown:

MIOTA: $0.4834 Market capitalization: $1 billion Trading volume: $4 million

Circulating supply of MIOTA “stock”: 2.779530283 billion

The above numbers as of Nov 11, 2018. The highest that MIOTA has ever traded at was $5.23 on Dec 18, 2017. It was worth $0.6385 on June 13, 2017, the date of its inception. If you buy $300 worth of MIOTA at the current price of $0.4834, then you’ve got 620 “shares” of IOTA (the ticker symbol equivalent – keep in mind that digital coin isn’t a stock).

If MIOTA hit its previous high and you decided to sell your position (all 620 “shares”), then you make off with $3,246. If Bitcoin rises again (some analysts would say “when” it rises), then you can almost certainly expect IOTA to do the same. It could be worthwhile to invest as much as you can, with the idea that you could make ten times as much if IOTA climbs back up to its previous high – and beyond.